The IDS Sanctions Solution can efficiently screen your book of business on a nightly basis, against the UK, UN, US and EU Sanctions List Targets. Identifying banned governments, as well as companies, groups, organisations, or individuals.

Sanctions Due Diligence for Brokers, Insurers and Reinsurers

Financial Crime is a key focus for both the Financial Conduct Authority (FCA) and Lloyds.

Brokers, insurers, reinsurers including those that operate delegated authority have an obligation to ensure they are sanctions compliant based on the nature, size, and risk profile of the business being written.

Without systems and controls in place to impede business relationships with high-risk individuals and entities, firms can face fines, penalties, and risk reputational damage.

IDS Sanctions Screening

The IDS Sanctions Solution automates the batch screening of clients, whether individuals, entities, or companies, against international financial sanctions lists.

On a nightly basis, client names for new business, renewals, and MTA's are cleansed and loaded via an API into the Sanctions Solution. These are checked against multiple Sanctions lists which are updated on a weekly basis. Adhoc searches can also be made.

Any new or changed targets that have been added to the Sanctions Lists are back-checked against all live clients, ensuring existing clients haven't subsequently been added.

Daily email notifications alert you on the number of matches found and results are stored within an Azure web solution. Which also supports you in recording actions taken. Together, with MI dashboards you have a full audit trail to support regulatory and capacity provider audits.

1)

Key Fields from your policy administration system are refreshed on a nightly basis whilst data quality routines cleanse the data within a secure Azure database.

The following can be included: Data Source, Forename, Initials, Surname, Full Name, Original Name, Sex, DOB (optional), Policy No, Sub Broker, Renewal Date, Transaction Type, Insurer, Company Name, Product type

2)

Matches are given a score based on the strength of the match, false positives can be reduced through the Logic applied which can be altered depending on your risk profile.

3)

All Sanctions Target Lists (UK,US, EU etc.) are updated on a weekly basis. When this happens the solutions backchecks live records to see if they have subsequently appeared keeping you constantly up to date.

4)

Within your Sanctions Solution you can fully manage alerts, once reviewed against the possible match the user has the ability to change the status and add notes along with Power BI dashboards providing a full audit trail on checks.

5)

Your policy administration records can also be updated automatically (dependant on your vendor).

Key Benefits of the IDS Sanctions Solution

The IDS Sanctions Solution can be integrated with any policy administration or underwriting system enabling seamless and efficient customer checks at a cost-effective price.

Each solution has its own database and secure web portal optimized within Microsoft Azure.

- Automates checks and alerts addressing inefficient manual methods

- IDS has specialist insurance data and system expertise

- Simple and effective in demonstrating governance with a full audit trail

- Following implementation there is a flat monthly hosting and support charge for unlimited users and unlimited checks

- Easily backload existing customers as a one-off exercise

- Customer data is only held within your Sanctions Solution whilst policies are live, when a policy lapses or is cancelled, PI data for that policy is obfuscated

Additional Sanctions Target Lists can be added if required (i.e., Sanctions lists from other countries or even your lists of clients or businesses you may not want to do business with again.)

SANCTIONS BATCH CHECKING SOLUTION FOR INSURANCE PROVIDERS

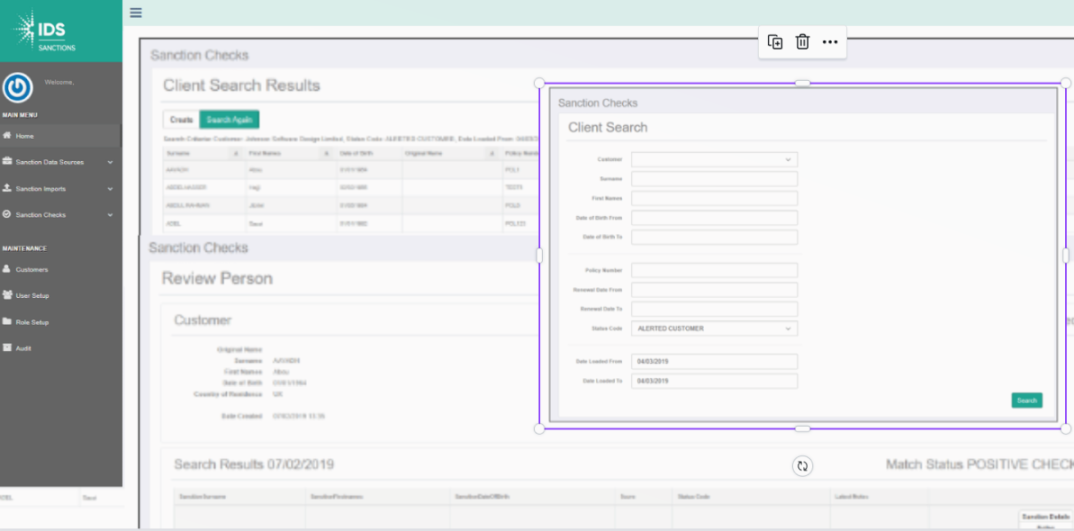

A Modern Secure Web Application Hosted in MS Azure with a User-Friendly Interface

Login to review the alerts with the ability to change the status and add notes

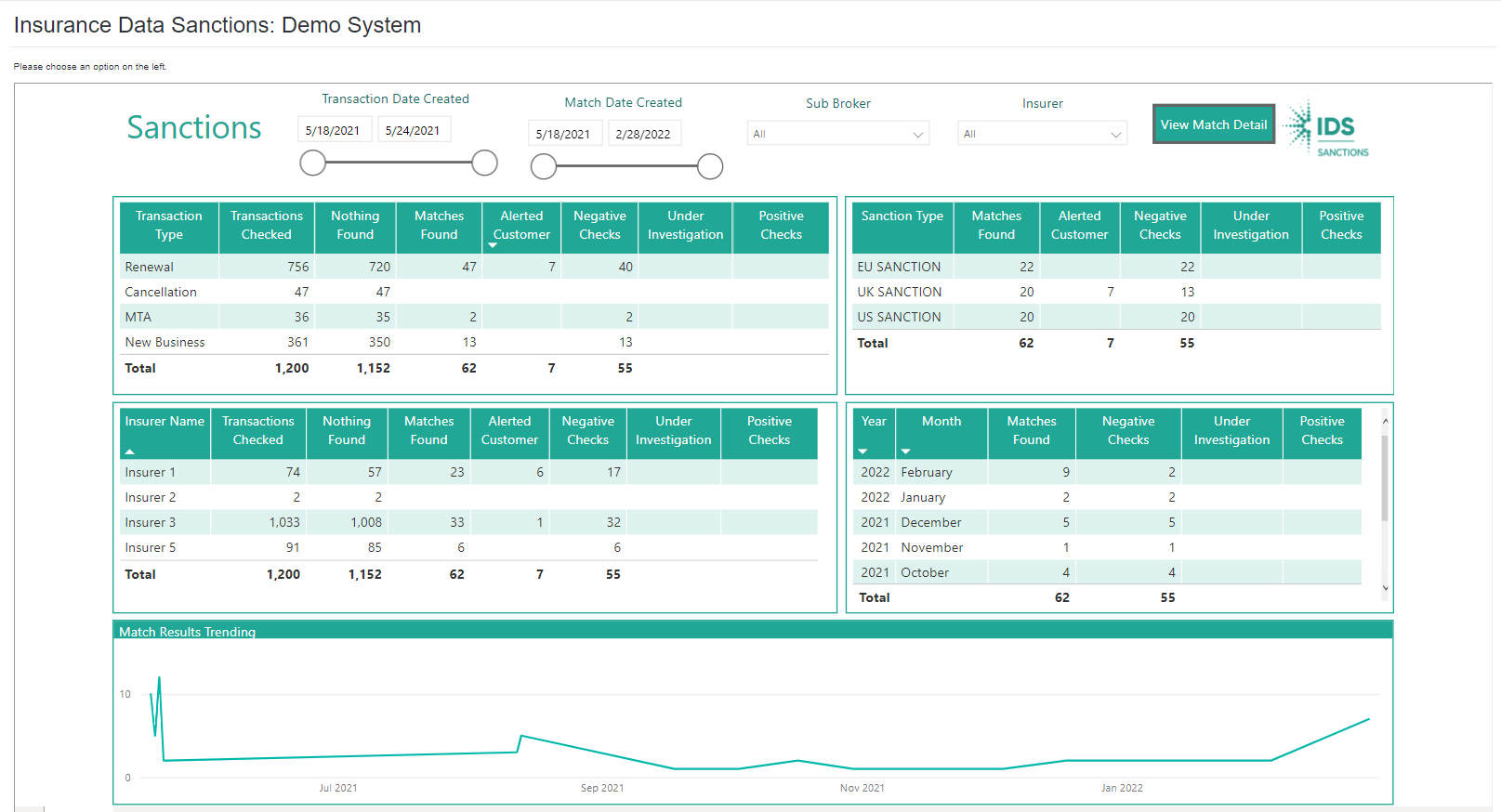

Embedded Power BI dashboards report on what searches have been carried out and the results obtained.

Sanctions checks by Transaction Type and number of possible matches and false positives.

- Filter by Broker or Insurer or by Date.

- Gain a clear view by month, sanction list type number of matches.

- Drill through to the underlying data to view match details.

- Export the underlying data for further reporting and analysis.

Sanction Targets Lists

UK Consolidated Financial Sanctions List

Drawn from UK, EU and UN sources, and maintained by the Asset Freezing Unit of HM Treasury.

The Specially Designated Nationals (SDN) List

Maintained by the Office of Foreign Assets Control (OFAC) in the US Treasury Department

Consolidated List Subject to EU financial Sanctions

Issued by the European Council

Other Sanction Target Lists

Further lists can be screened to reflect your risk exposure and screening rules.