Moor Gardens Offices, Maldon Road

Hatfield Peverel, Chelmsford

Essex

CM3 2JP

United Kingdom

Telephone: +44 (0)1245 608253

Our client is one of the largest independent (re)insurers operating in the Lloyd’s market. Offering insurance and reinsurance around the world, the group employs over 1700 professionals in seven different countries. As of 31st December 2012, net assets stood at £1.5bn.

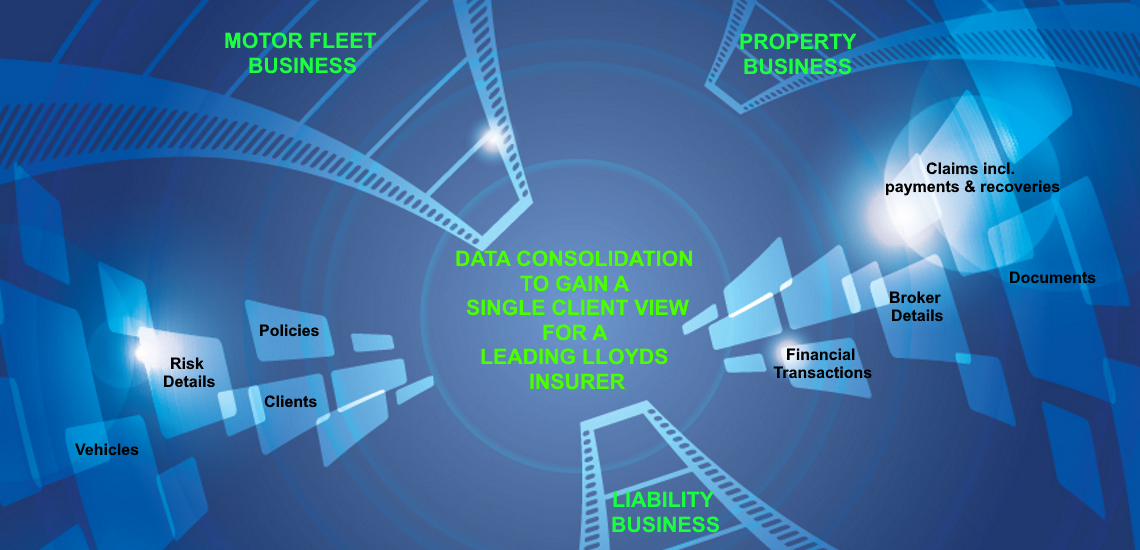

In 2007 Insurance Data Migrations (IDM now IDS) was appointed to migrate their Motor Fleet business to a bespoke state of the art Microsoft-based underwriting system. To gain a single client view they had a five-year plan to consolidate Motor Fleet, Property and Liability LOBs on to the bespoke system.

Previously, the client had had a number of failed attempts in migrating the data for phase one, so there was a level of anxiety as a result of project overruns. They had tried several times to extract data from their legacy system, each time not quite meeting the standards required to execute the migration and as a result communication and motivation within the team had also become difficult.

Motor Fleet Business Data Migration: 2007

The Phase One assignment in 2007 was to migrate the motor fleet line of business to a newly developed bespoke system. The migration was to include broker details, clients, policies, risk information, vehicles, claims (including payments & recoveries) and financial transactions. The data came from a variety of systems and sources, including UNIX platforms and MS Access databases.

After the initial analysis of the legacy data had been completed IDM (Insurance Data Migrations) swiftly built a successful migration which met all the expectations of the business. Our IDM team developed modules that extracted the data. It was then formatted and cleansed before importing it into the target system. The modules were a mixture of 3GL programs and DIBOL to extract the data, Microsoft SSIS routines to bulk load into SQL Server 2005, SQL TSQL and Common language routines written in C# to migrate and transform the data through the staging areas.

Once the project was underway IDM managed the migration and supported testing utilising some of the client’s existing resources. IDM held regular requirements and progress meetings with the stakeholders that drove the project forward and ensured the rules laid out by the business were maintained.

The complexities of this project included:

The new target system was still in its final phases of development and this development was taking place in parallel with the data migration.

The data cleansing stage of this migration was also very complex, for example:

For the load and acceptance testing stages of the migration, IDM developed a series of scripts & checklists for the testers so they could perform various spot checks of the data. This ensured that it appeared as expected and the business processes and interfaces worked correctly.

In total for Motor Fleet, IDM migrated over 20,000 clients and policies, 300,000 claims’ and 300,000 vehicles dating back to 1993.

Throughout this project, IDM maintained an excellent relationship with the client. As a result of the reconciliation success rates and accuracy of the fleet, migration IDM was awarded the contract to migrate their liability and property lines onto the new bespoke system.

The second phase of this strategic business change program for the client started in July 2009 and included migrating the liability retail book of business from a Microsoft-based bespoke system to the new bespoke underwriting platform. The migration was underway before the development of the bespoke system was complete to cater for liability business so IDM worked closely alongside the development team.

This entailed the migration of 20,000 Liability policies, along with the associated risk details, claims details and financial transactions.

A complexity of this migration was merging the liability data into both the existing motor fleet data and into the newly keyed in data that had been entered since the system went live. Therefore to remove duplication and create a single client view, IDM ran a parallel project to map all of the duplicate liability and fleet clients together.

Over the course of the migration, the bespoke target system was also still being developed for the Liability book of business.

The client’s liability book of business successfully transferred and went live over a single weekend in early 2010.

Following on from the successful motor fleet and liability migrations, IDM was instructed to carry out the third phase of the migration in January 2012.

This phase of the strategic business change program entailed migrating the Property business onto the new system from three different underwriting platforms; Websure, a bespoke system and a quotes logging system. IDM’s migrated around 100,000 policies from the three systems, along with the associated risk detail, claims details and financial transactions.

The main complexities of this phase were merging the property data into the production system that held the motor fleet and liability data, which we had previously migrated, plus into any newly keyed in data. This involved a parallel project where IDM mapped all of the duplicate liability, fleet and property clients together to remove duplication and create a single client view.

For all three of the Property business legacy systems, IDM only migrated some of the business, leaving behind policies and claims which were not in the scope for the property project - thus requiring the legacy systems to continue working with the out of scope business after the go-live date. This meant that as part of the go-live project we locked down the migrated policies and claims on the legacy systems, ensuring that no further processing could take place on these records. This was successfully carried out alongside further system development to enable the new system to cater for Property business.

The Property business migration successfully went live in January 2013 over a single weekend causing no disruption to the business.

As a result of these three migrations, IDM helped the insurer consolidate their key lines of the business to a state of the art bespoke system to gain a single client view. By converting by line of business property, fleet and liability are now integrated rather than on disparate systems and data quality and transparency has been improved. By rationalising the number of systems used to support the business the potential benefits include reduced maintenance costs, improved speed to market, more efficient processing and improved customer service.

IDS continues to this day to be a trusted supplier for this Leading Lloyds Insurer delivering not only data migrations but also a wide range of data services which ensure data quality supporting underwriters, marketing, catastrophe modellers, actuaries, binder management etc. with BAU activities, management information and regulatory reporting.