Insurance Data Solutions

Moor Gardens Head Office,

Maldon Road

Hatfield Peverel, Chelmsford

Essex

CM3 2JP

United Kingdom

Telephone: +44 (0)1245 608253

A multi award winning, global Insurance broker with 50,000 clients in 125 countries, was receiving numerous monthly insurer claims bordereaux, all of them in differing formats and of variable data quality.

Management Information teams manually processed, cleansed and consolidated the spreadsheets using MS Excel as the main tool for both manipulation and output. Claims handlers then manually entered claims data in to a dedicated Claims Management System. This was widely regarded as a painstaking process that added human error, made corrections difficult to track and tied up valuable resources in protracted workflows, taking time away from the real tasks of analysing performance and dealing with clients.

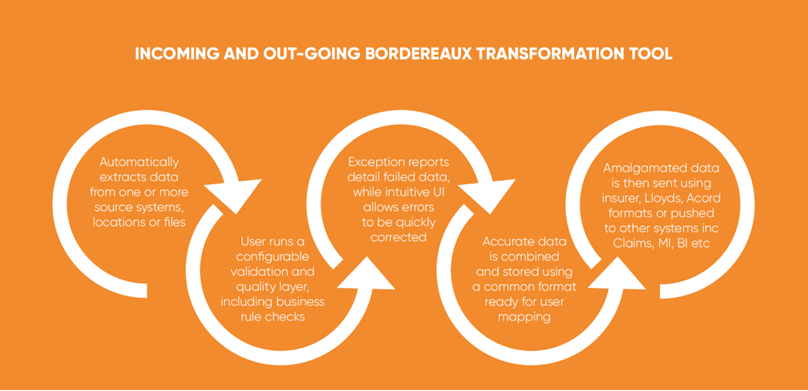

Our client selected IDS to build a Incoming Claims Bordereaux Solution. Via a user-friendly web interface with secure user login authentication, the solution allows business users to, import data from spreadsheets or other ad-hoc sources, apply Business Rules, configure Validation & Data Quality checks, view reports detailing failed data, correct or amend data errors, define mapping and schedule data extracts to be pushed directly into the Claims Management system.

The architecture is scalable, effectively allowing an unlimited number of data sources to be imported and transformed into a common format, supporting industry standards (incl. Lloyds and Accord). The system improves transparency as each step of the transformation stores control totals into a permanent control file, available for audit purposes.

With the solution delivering a single version of truth, our client not only pushes the consolidated data straight in to their Claims system but has also begun exporting data to various MI and BI Visualisation tools, improving confidence in the analysis of claims processes. The solution sits entirely within their own architecture, though it is as easily deployed within a secure Microsoft Azure Cloud in the UK.

Claims bordereaux now flow into the system, are cleansed and consolidated automatically, and the result is then scheduled to be pushed to the MI team and Claims system. The MI team is now free to concentrate on analysing consistent, high-quality data, and Claims Staff no longer manually input lengthy claims detail, eliminating time wasted on data entry. Human errors created in the manual transfer of data have been removed helping to deliver rapid ROI and improving collaboration between the broker and its insurers.