Insurance Data Solutions

Moor Gardens Head Office,

Maldon Road

Hatfield Peverel, Chelmsford

Essex

CM3 2JP

United Kingdom

Telephone: +44 (0)1245 608253

NBS Underwriting is a fast-growing, award-winning MGA (est. 2011) with £117m+ GWP and ~100 staff across five locations in the UK and Ireland, delivering tailored solutions across 40+ specialist lines.

Guided by “making brokers’ lives easy,” NBS offers fast, accurate quotes, direct access to highly skilled underwriters, and BDM support—backed by A‑rated capacity from Hadron UK, Accelerant, Hiscox, Tokio Marine HCC, Allied World, and ARAG. NBS combines capacity strength with specialist underwriting expertise to provide brokers and their clients with market-leading solutions.

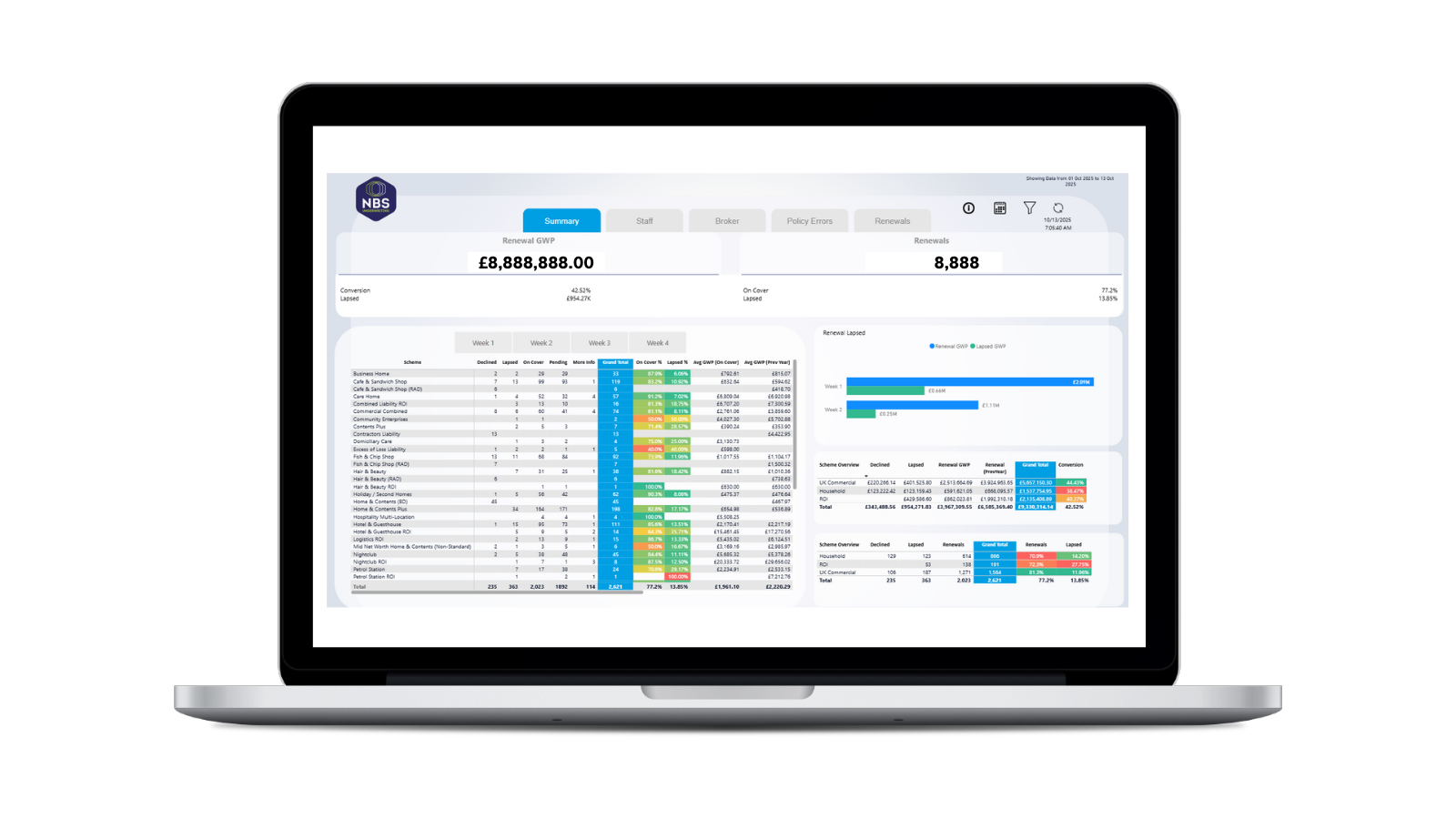

NBS Underwriting Power BI dashboard - Renewal Retention

NBS faced growing volumes of data across products, brokers, and schemes, sourced from SchemeServe and manual spreadsheet-based MI. This created several operational hurdles:

To strengthen its broker-first commitment, NBS partnered with IDS to implement a scalable, secure, and self-service analytics solution.

IDS delivered a SaaS platform with:

Each release was supported by a “confidence pack” including UAT results, reconciliation summaries, and KPI definitions. Parallel-run reconciliations against SchemeServe and legacy MI validated data integrity, while automated alerts on load failures ensured ongoing reliability.

Thanks to close collaboration between NBS and IDS, the scalable analytics solution was designed, built, and deployed in just three months—

At the heart of the solution is a governed insurance data warehouse—designed as a single source of truth. Built on IDS’s specialist insurance model, it enables:

IDS experienced BI Team co‑designed with NBS operations, underwriting, and leadership input to ensure KPI and insights matched real decision points:

Structured UAT cycles were complemented by defect triage and formal sign-off processes, supported by parallel data reconciliations against Scheme Serve and legacy MI systems to ensure data integrity.

Automated alerts for load failures were implemented to maintain system reliability and enable prompt issue resolution.

To support the onboarding process, IDS met weekly with NBS during the development phase. IDS also provided training for NBS on effectively using their Analytics framework and dashboards.

The training also covered key areas, including user management, role-based access control (RBAC), and the IDS Support Desk SLA Portal.

Our collaboration with IDS has brought a real step change in how we manage our insurance data at NBS, and it has significantly enhanced the way we access and analyse key metrics. While we already had processes in place, transitioning onto the IDS Analytics Solution has introduced a level of automation and efficiency that has saved us considerable time in producing our daily, weekly and monthly MI. More importantly, it has provided us with deeper, real-time insights into our data—enabling us to identify trends, flag issues early, and make quicker, more informed decisions. This has been especially valuable when it comes to managing our broker relationships. With clearer visibility across performance and exposures, we can have more meaningful and proactive conversations with our partners, which helps us build stronger, more trusted relationships. The IDS team has worked closely with us from day one, and it’s been a genuine partnership. We’re excited to continue developing how we use the platform as our needs evolve." Rachel Oldroyd, Director of Operations, NBS Underwriting

AREA |

PAIN POINTS |

IDS ANALYTICS BENEFITS |

MI Production |

Time-intensive manual import and preparation. (SchemeServe / Excel) | 10+ days saved per month, freeing time for analysis. Improved operational efficiency and governance. |

Accuracy and Consistency |

Inconsistencies and duplicated mapping | 95% fewer errors, with a governed data warehouse with mastered brokers, schemes, and insurers |

Agility and Insight |

Static reports, limited drill through | Faster insight-led decisions; stronger capacity negotiations |

Access and Assurance |

Shared spreadsheets, version conflicts | Security 2FA, Role-based access control (RBAC), audit trails, and reconciliations |

Scalability and Interactivity |

Excel Struggles with volume | Scales with business growth, SAAS Platform |

Claims and Triangulations |

Manual spreadsheets, limited triangulations | Early trend detection on scheme profitability - interactive, allowing you to drill through to the underlying data |

Broker Analysis |

Manual prep, inconsistent | Prioritises strategic accounts, identifies rising stars/risks. Supporting fact-based negotiations, identifies opportunities to incentivise brokers for either new business generation or retention improvement by scheme. |

Budgets and Forecasting |

Data integration | 30% faster budgeting and forecasting (plan vs actual) aligned to near-realtime performance data. |

New Business |

Pivot style manual spreadsheets | Up-to-date visibility of scheme conversion and outcomes. |

Renewal Retention |

Spreadsheets were updated twice a month, requiring manual interventions | Daily accurate renewal pipeline view, with gaps/issues highlighted early for timely action. Automated updates with error flagging for missing quotes. |

Broker Pack Production |

Time-intensive manual preparation of broker reports | On-demand PDF/PPT exports with commentary space. Saves time, ensures consistency, builds professionalism, and strengthens broker relationships. Shows transparency and trust — by openly sharing performance data on premiums, claims, renewals, and new business. Gives brokers confidence that you understand their book and value the relationship. Helps spark constructive conversations around growth, retention, and target setting. |

Daily Volumes |

Daily manual spreadsheet | Near real-time monitoring of underwriting activity. Giving Team leaders self-service access to monitor performance and keep sales and conversions on track. |

Final Report |

Long spreadsheet, manual data quality checks, email updates | Automated daily board report distributed to stakeholders. Comprehensive report tracking KPIs performance results against budget at scheme level, top brokers, yoy comparisons, and daily NB / Renewals across the UK and RIO |

With a robust MI foundation now in place, NBS is moving forward—at pace—into real-time underwriting intelligence and automated regulatory reporting.

With this secure foundation, NBS is equipped to:

IDS helps insurers, MGAs and brokers turn operational data into governed, decision-ready dashboards and MI. With deep experience in the insurance industry, our team of data engineers and BI developers understand insurance and delegated authority processes, business rules, as well as the challenges and nuances of different policy administration systems. We speak the language of insurance — giving you instant confidence in the insight we deliver.

IDS Analytics offers a secure, cost-effective framework for self-service analytics and decision-making insights. Offering a single source of truth that integrates multiple data sources into an insurance-ready data warehouse model.

Security and governance are embedded through two-factor authentication (2FA), role-based access controls (RBAC), and comprehensive audit controls, ensuring the right people see the correct data for operations, sales, and underwriting with complete accountability.

From this foundation, self-service Power BI dashboards refresh automatically, offering interactive visuals, filters, and drill-through detail to access the underlying data. Monitor KPIs in real time with alerts, enrich performance with targets, budgets, and external data, and save time by replacing manual reporting with governed automation — ensuring accuracy, compliance, and consistency across your MI landscape